In a recent From the Helm interview with Bell Financial Group, SenSen Networks CEO Dr. Subhash Challa shared an in-depth look at the company’s foundations, global traction, financial performance, and future growth strategy. The discussion revealed a business that has moved from university research to global leadership—powered by breakthrough AI, expanding recurring revenue, and a massive untapped market opportunity.

From University Spin-Off to Global AI Leader

SenSen Networks began as a spin-off from the University of Technology Sydney, created from advanced computer vision and AI research led by Dr. Challa and his PhD students. What started as academic innovation is now a global enterprise delivering AI-powered automation to city councils and large government agencies across the world.

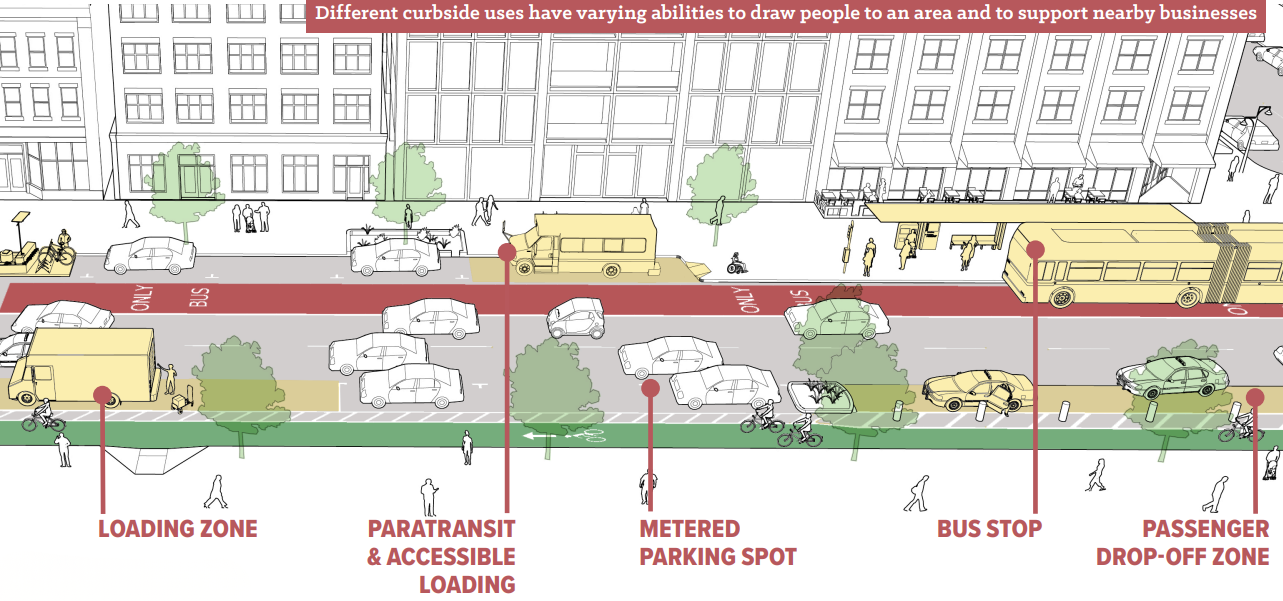

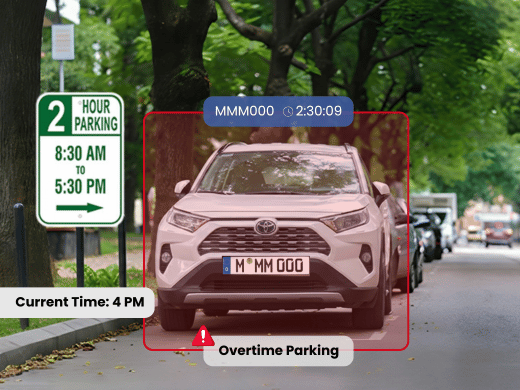

At its core, SenSen solves a growing urban challenge: how cities manage limited curb and footpath space as populations increase. Traditional enforcement relies on manual inspection—officers walking long distances, exposed to the elements, and limited in scale. SenSen’s technology automates this entire process.

Automating Curbside Management: A Global Problem Worth Solving

Curbside space—loading zones, taxi bays, bus bays, no-stopping zones—is one of a city’s most constrained assets. Cities try to ration this space using signage, rules, and time restrictions, but no regulation works without effective enforcement.

Dr. Challa notes that cities face two major constraints: Not enough inspectors to cover hundreds of kilometres of curb and manual enforcement is slow, unsafe, and inefficient. SenSen’s AI solves this by enabling automated curbside monitoring, evidence capture and compliance alerts, enforcement handled from in-vehicle or back-office systems and scalable coverage across entire cities

This means safer roads, reduced congestion, and faster parking availability—a universal challenge in all major cities worldwide. Today, SenSen operates in Australia, New Zealand, Singapore, Canada, the United States, and is expanding into more regions.

FY25 Financial Results: Strong Growth in a Tough Environment

SenSen delivered revenues of $15.4 million in FY25, representing 25 percent year-on-year growth in a challenging economic environment. Growth was driven by both new contracts and deeper adoption within existing cities. Montreal became one of SenSen’s flagship wins, and Calgary, after conducting a global retender, renewed its relationship with SenSen for another nine years. These milestones contributed strongly to top-line growth.

Equally important is the organic expansion happening within cities already using the platform. Most cities expand their monitored curb length by 15 to 20 percent each year as they embed automated enforcement more deeply into their operations. This consistent organic lift, combined with new wins, has contributed to SenSen’s multi-year revenue trajectory, which has increased from $5 million to $9 million to $12 million and now $15.4 million.

A Massive Global Market: 10,000+ Cities, 60 Already Using SenSen

SenSen is currently deployed in 60+ cities globally, including some of the world’s most advanced smart cities: Vancouver, Brisbane, Singapore, Montreal and Calgary.

But the total global city market is over 10,000, meaning SenSen has captured less than 1% of its potential footprint.

Even within individual cities, the growth opportunity is significant. For example, Brisbane has ~800 km of curb, but SenSen currently monitors only ~50 km. This provides years of runway within each customer.

SenDISA Data Fusion AI Platform: The Core Differentiator

SenSen’s core platform, the SenDISA Data Fusion AI engine, integrates data from cameras, sensors, and enterprise systems to deliver real-time operational intelligence. This is the foundation that allows the company to automate curbside enforcement efficiently and accurately.

Dr. Challa noted that patents protect several core components of the technology, but what truly differentiates SenSen is the long history of refinement and operational experience. Government customers are highly risk-averse and rarely adopt early-stage technologies. Many startups do not survive the long evaluation cycles required to gain their trust, while older incumbents often rely on manual staffing models that cannot transition easily to automation. SenSen occupies a rare middle ground as a proven innovator with more than fifteen years of market experience, allowing it to lead the category while partnering with traditional providers rather than competing with them.

Recurring Revenue is Now Two-Thirds of Total Revenue

SenSen reported $15.4 million in FY25 revenue, of which approximately $9.6 million was recurring “over-time” revenue. About one-third of total revenue came from upfront project work, and two-thirds came from recurring annualised contracts. As cities continue expanding their deployments and new cities come online, SenSen expects the recurring revenue proportion to continue increasing.

Profitability & Cash Flow: Six Consecutive Positive Quarters

The company has now achieved six consecutive quarters of positive operating cash flow, supported by rising revenues and tightly managed operating expenses. SenSen has reached a scale where revenue and profits exceed the cost base, meaning new revenue contributes more directly to margins.

Gross margins have increased from around 60 percent to more than 79 percent and are expected to approach 90 percent as the platform continues to scale. While dividends are not on the near-term roadmap, the company intends to reinvest its cash flows into expanding sales capabilities, entering new cities, and strengthening its technology leadership.

Global Sales Engine: Teams, User Forums & Partnerships

SenSen maintains sales and marketing teams in Australia, Singapore, and North America, each working to grow market share. One of the company’s most effective growth mechanisms is its network of user forums, where councils share experiences and best practices. Unlike commercial industries where competitors guard information, cities actively learn from one another. This peer-driven adoption has helped SenSen accelerate its penetration across regions.

Channel partnerships also play a critical role. Some partners servicing North America already have relationships with more than one thousand cities. By enabling these partners to introduce SenSen technology into their networks, the company significantly expands its reach without proportionally increasing operating expenses.

What Investors Can Expect Over the Next 12 Months

Investors can anticipate strong continued growth across North America, further expansion within existing cities as curbside coverage increases, and new customer acquisitions supported by partner-led sales. Both the geographic opportunity and the per-city expansion potential remain substantial, giving SenSen a clear runway for multi-year growth.